Gross Profit Shrinking?

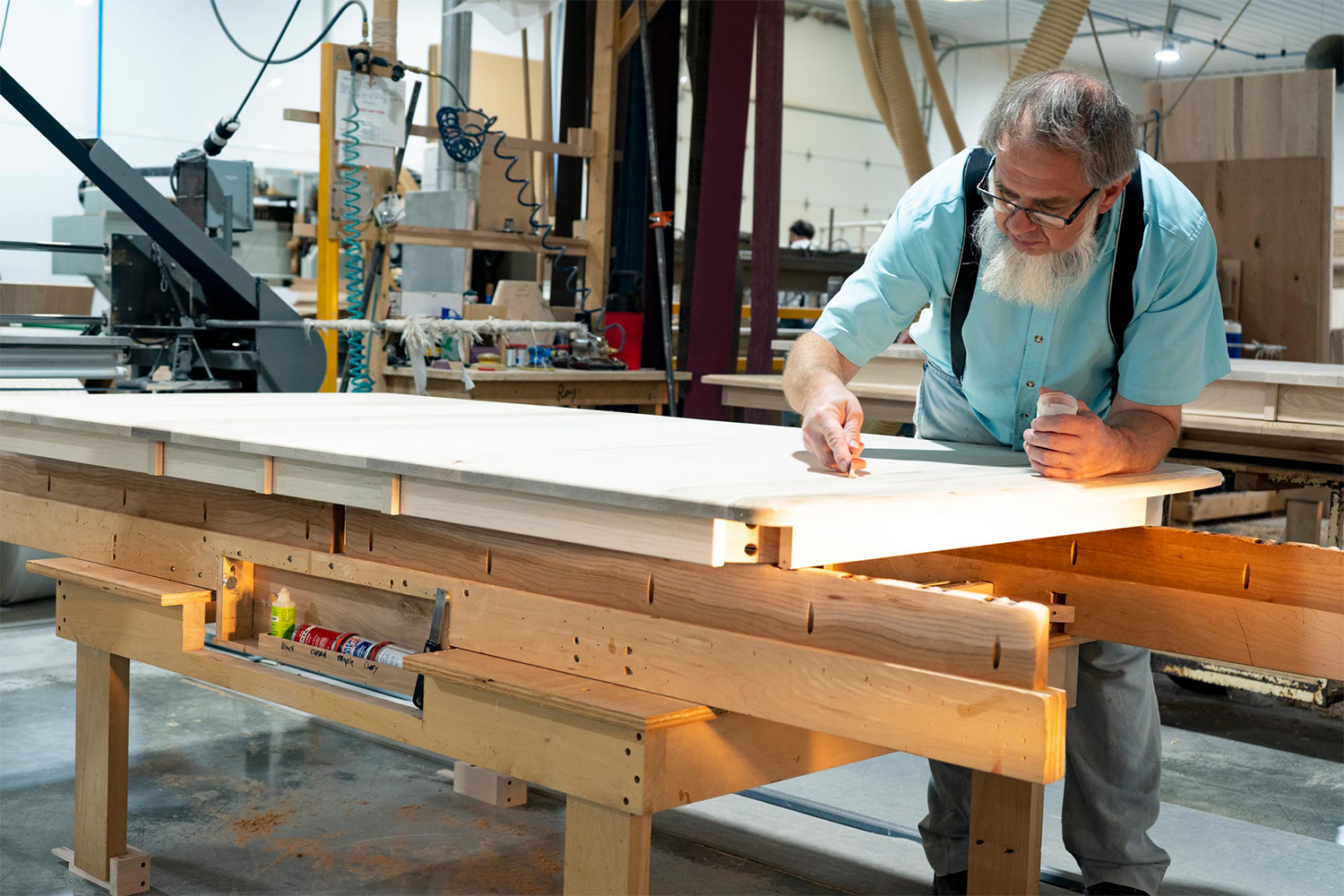

Transition to Amish Furniture

Analysts at S&P Global have warned that the latest rounds of tariffs, ranging from 10% to 25%, are squeezing margins for furniture retailers. As a result, some brands have announced list price increases of 4% to 10% to offset the additional duty costs. Meanwhile, Google Trends indicates that U.S. interest in "American-made furniture" has surged by approximately 70% since 2022, reflecting stronger consumer demand for domestically sourced products. Making it a good time to transition your showroom to Amish furniture.

How 3 Furniture Retailers Beat Market Changes

This case study explores how three retailers from Ohio, New York, and Indiana adapted early to the changing market conditions, protected their profits, and tapped into the growing "buy local" segment. It also highlights the data they used before raising their purchase order minimums again.

Find Out What Retailers Need To Know

Top-Selling Styles: Simple Shaker and clean-line pieces now lead sales across all three stores. See why customers pick them — and which stain families pair best.

Price vs. Value: See how retailers sold $1.5 k tables without discounting.

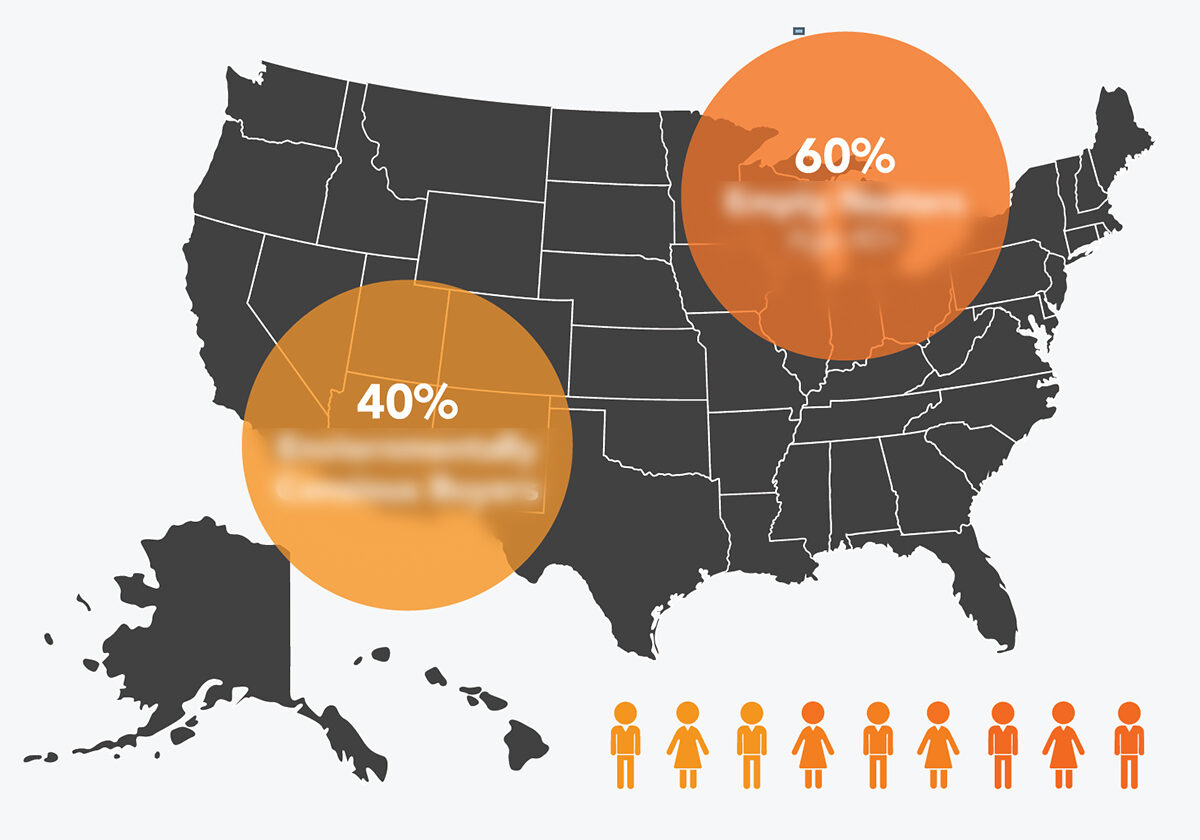

Who’s Buying Amish Now?: Peek at the two fastest-growing segments, and see how retailers tailor showroom pitches to each.

MEET VIZTECH — YOUR AMISH BRIDGE

We built VIZTECH to connect retailers with Pennsylvania, Ohio, and Indiana’s finest Amish builders—minus the guesswork. Our portal centralizes catalogs, live pricing, and high-res product files so you can quote, sell, and order without juggling phone trees or paper forms. Think of us as the digital handshake that respects Amish tradition and modern retail speed.